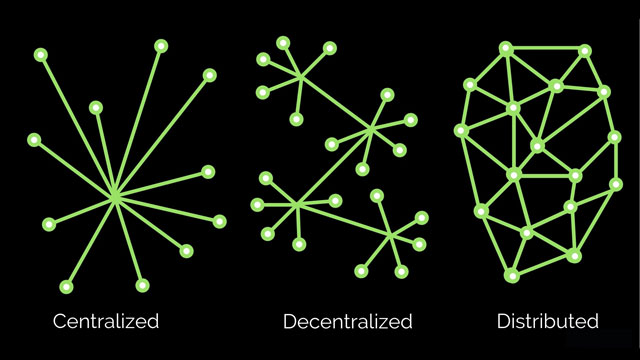

DeFi stands for Decentralized Finance

Decentralized Finance is a blockchain-based form of finance that does not rely on central financial intermediaries.

There is a massive learning curve when it comes to deciphering the relevance of words or expressions vis-à-vis of both the technical implications and their financial ramifications.

Cryptocurrency

A digital currency in which transactions are verified and records maintained by a decentralized system using cryptography, rather than by a centralized authority.

CBDC

A Central Bank Digital Currency is a centralized digital form of a nation’s fiat currency using blockchain-based token.

NFT or Non-Fungible Token

Non-Fungible Tokens or NFTs are cryptographic assets on blockchain; unlike cryptocurrencies, they cannot be traded or exchanged at equivalency.

Bitcoin

The earliest cryptocurrency bitcoin is created, distributed, traded, and stored with the use of a decentralized ledger system, known as a blockchain.

Altcoin

The term is said to stand for “alternative to Bitcoin” and is used describe any cryptocurrency that is not a Bitcoin such as Ethereum, Ripple, Doge, etc.

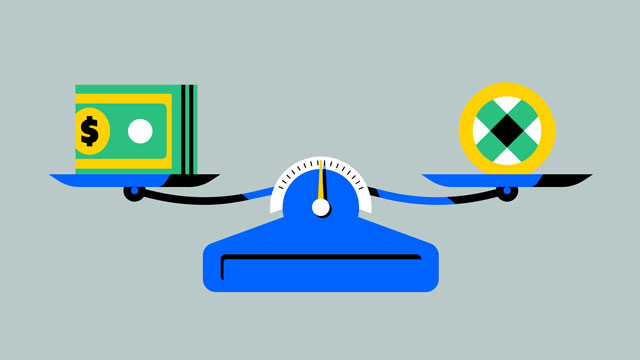

Stablecoin

A stablecoin is a new class of cryptocurrencies that attempts to offer price stability and can be pegged to a currency, commodities, or fiat money.

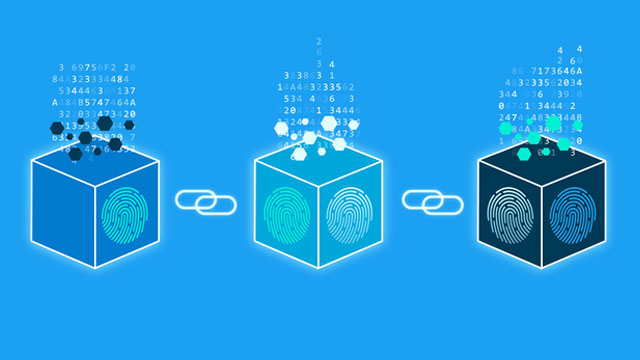

Blockchain

A system in which a record of transactions made in bitcoin or another cryptocurrency are maintained across several computers that are linked in a peer-to-peer network.

Smart Contract

Traceable, transparent, and irreversible self-executing contract with the terms of the agreement between buyer and seller being directly written into lines of code.

Quantitative Easing

The monetary policy tool used by a central bank to influence the supply of money in the economy to expand and artificially stimulate economic activity.

Where do you start if your company is considering moving part or all of the treasury to digital assets?

When considering transitioning to digital and crypto assets; there plenty of questions that need to be asked in order for a compelling answer specific to a company’s unique situation to be given.

Bitcoin ETFs or Close-Ended Funds

why invest directly in Bitcoin instead of a Bitcoin-focused ETF or hedge fund?

What are the main benefits

of digital assets that can convince your company to move from fiat or gold?

What are the differences

between the various digital and crypto assets and their most common uses?

What factors are impacting

the value, volatility, and sustainability of digital assets?

How to manage risk

when it comes to the securing, building confidence, and insuring digital assets?

What resources are available

to purchase, exchange, store, and manage digital assets?

What are the costs

associated with investing and transitioning into digital assets?

How would financial statements

reflect your company moving part or all of the treasury to digital assets?

What are the taxation

implications and opportunities with CRA when you transition into digital assets?